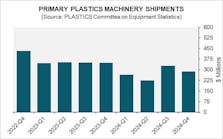

North American shipments of injection molding and extrusion machinery slowed in the third quarter, according to statistics compiled by the Plastics Industry Association’s Committee on Equipment Statistics (CES).

The value of shipments was estimated at $353.8 million — down 14.4 percent from Q2, but up 6 percent from the previous year’s number.

The value of shipments of injection molding machines fell 17.1 percent in Q3, while shipments of single-screw extruders rose 4.9 percent, and twin-screw extruders rose 12.4 percent. Compared with Q3 of last year, single-screw extruder shipments fell 13.1 percent, and twin-screw extruders rose 19.3 percent.

PLASTICS Chief Economist Perc Pineda said, “It can be argued that the slowdown in plastics machinery shipments in the third quarter is in sync with the cooling of the U.S. economy. However, compared to the quarterly shipments in 2021 — a stellar year for the plastics industry particularly for plastics equipment suppliers — this year’s third-quarter shipments remain above the first three quarters’ shipments last year.”

Looking at the sentiment of survey respondents, Pineda said “The outlook for the next 12 months [being] virtually unchanged from the second suggests that plastics equipment suppliers have considered slower economic growth ahead and have not strategized accordingly for ... 2023.”

In Q3, exports of plastics machinery fell 10.2 percent to $198.8 million, and Mexico and Canada stayed steady in the quarter as the top export markets of U.S.-made plastics machinery. Exports to U.S.-Mexico-

Canada Agreement partners totaled $109.7 million, which accounted for 65.9 percent of total U.S. exports of plastics machinery. Imports fell 12.1 percent to $423.6 million in Q3, and the U.S. plastics machinery trade deficit dropped from $260.7 million in Q2 to $224.7 million in Q3. A strong U.S. dollar and efforts to moderate global economic growth are slowing plastics machinery trade.

“In sum, the third-quarter data is consistent with the projected growth in plastics machinery shipments for the second half of 2022,” Pineda said. “However, the U.S. manufacturing sector continues to face headwinds — elevated energy prices, rising interest rates and inflation — which could weigh on the economy’s manufacturing output in 2023.”