PLASTICS: Machinery shipments declined in Q4 2023

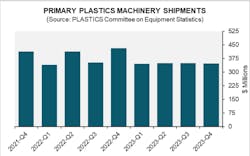

The Plastics Industry Association (PLASTICS) Committee on Equipment Statistics (CES) reported that shipments of primary plastics processing machinery declined in the fourth quarter of 2023.

The preliminary estimate showed a shipment value of $348.1 million for the quarter. While the decline from Q3 2023 was only 0.4 percent, the year-over-year (Y/Y) figure was more dramatic, down 19.5 percent from Q4 2022.

Single-screw extruders showed a 19.5 percent decrease quarter-over-quarter (Q/Q), but a 4.9 percent increase Y/Y. Twin-screw extruders also dropped 19.4 percent Q/Q and 23.8 percent Y/Y. Injection molding shipments increased by 3.8 percent Q/Q but decreased 21.1 percent Y/Y.

“Last year saw minimal fluctuations in quarterly plastics machinery shipments. The modest upturn observed in the second quarter was short-lived, with shipments remaining steady until the year's end,” said Perc Pineda, chief economist at PLASTICS. “The decline in U.S. manufacturing activity, coupled with a high-interest-rate environment, contributed to a slowdown in business investment spending, including in plastics machinery.”

The latest CES quarterly survey polling plastics machinery suppliers for market insights and equipment expectations showed a notable uptick in participants anticipating improved market conditions over the next 12 months compared to the previous year. The percentage of those expecting conditions to either remain the same or improve rose to 82.9 percent, compared to 56.1 percent in the prior quarter.

U.S. exports of plastics equipment saw a 5.1 percent increase in the fourth quarter, to $284.6 million from Q3. Y/Y exports rose 19.6 percent. Mexico and Canada remained the top export markets for U.S. plastics equipment, with a combined export share of 62.3 percent. Nearly half of all exports, $124.3 million, went to Mexico, $53 million to Canada. Imports increased 11.7 percent Q/Q, reaching $427.6 million, but dropped 14.1 percent Y/Y.

“While the unexpected 2.5 percent U.S. economic growth in 2023 averted a recession, primarily fueled by robust household spending in the services sector, signs of recovery may emerge in 2024. Sustained consumer spending could prevent economic deterioration, especially if labor markets continue to stay healthy. As interest rates begin to return to normalcy from inversion, there’s a likelihood that business investment, including in equipment, will reverse course,” Pineda said.