PLASTICS Committee on Equipment Statistics issues Q4 report

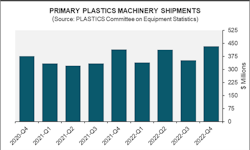

According to the Plastics Industry Association’s (PLASTICS) Committee on Equipment Statistics (CES), shipments of injection molding and extrusion machinery in North America increased in the fourth quarter of 2022. Data from reporting companies resulted in a preliminary estimate of total shipment value totaling $432.7 million. The 22.3 percent fourth-quarter increase represented a turnaround from the third-quarter 14.4 percent decrease. Compared to just a year earlier, shipments increased by a total of 4.4 percent.

The value of single-screw extruders increased by 34.6 percent from the third quarter, followed by injection molding shipments at 25 percent and shipments of twin-screw extruders at 8.9 percent. Compared to the previous fourth quarter, single- and twin-screw extruder shipments increased 7.6 percent and 25 percent, respectively. Injection molding shipments were 2.9 percent higher compared to a year earlier.

“The U.S. economy pulled through in the second half of 2022,” according to Dr. Perc Pineda, chief economist for the PLASTICS Industry Association. “The increase in plastics machinery shipments in the fourth quarter speaks of the importance of plastics manufacturing and the stable demand for plastic and plastic products in the economy last year. As expected, the increase includes shipments of backlog production resulting from supply chain problems in previous quarters.”

Additional data:

-

Exports of plastics machinery decreased by 10.2 percent to $198.8 million in the third quarter.

-

Mexico and Canada remained the top plastics machinery export markets for the U.S.

-

Combined exports to U.S.-Mexico-Canada Agreement partners represented 65.9 percent of total U.S. plastics machinery exports.

-

Imports of plastics machinery decreased by 12.1 percent to $423.6 million in the third quarter.

-

The U.S. plastics machinery trade deficit narrowed from $260.7 million in the second quarter to $224.7 million in the third quarter.

“It is still expected that the U.S. economy will continue adjusting to its long-run growth rate after robust recovery in 2021 from the pandemic,” added Dr. Pineda. “Strong economic data earlier this year supports the argument of further financial tightening by the Federal Reserve to bring the economy back to an inflation rate that promotes sustainable level of output growth. I had previously said that Q4 2022 shipments would surpass Q3 2022 shipments — and that’s exactly what we got,” concluded Pineda.