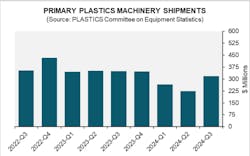

Plastics machinery shipments rise in Q3

Shipments of injection molding and extrusion machinery rose 41.9 percent in the third quarter compared with the previous quarter, according to the Plastics Industry Association (PLASTICS) Committee on Equipment Statistics (CES).

The total shipment value was estimated at $319 million, up from $224.8 million in the second quarter. However, shipments were down 8.8 percent year-over-year (Y/Y).

Twin-screw extrusion shipments saw the most significant growth, with a 149.7 percent increase quarter-over-quarter (Q/Q) and 43.1 percent year over year (Y/Y). Single-screw extrusion shipments rose 31.9 percent Q/Q but were down 27.8 percent from Q3 of 2023. Injection molding shipments rose by 34.3 percent Q/Q but fell 11.1 percent Y/Y.

“The rebound in primary plastics equipment shipments in the third quarter confirms our Q2 statement that growth prospects remain, aligning with the positive outlook for the broader plastics industry — not just equipment,” said PLASTICS Chief Economist Perc Pineda. “With baseline demand for plastic products holding steady, demand for plastics equipment is likely to grow over time.”

The survey showed 70 percent of respondents expect improved market conditions over 2025. Additionally, the percentage of respondents reporting an increase in quoting activity rose to 42 percent, from 40 percent in the previous quarter.

U.S. plastics equipment exports rose by 2.1 percent Q/Q to $348 million, but were down 19.9 percent Y/Y. Mexico and Canada accounted for a combined $156.4 million, or 45 percent of U.S. plastics machinery exports in Q3.

“U.S. manufacturing has faced an interest rate-driven slump. The Fed’s recent rate cuts — a 50-basis-point cut in September, followed by 25 basis points in November, and likely another 25 basis points in December — are expected to bring the Fed funds rate to a target range of 4.25-4.5 percent. This should gradually help the manufacturing sector move past the recent downturn,” Pineda said.