IMM makers offer help for cutting energy use

By Karen Hanna

Recent disruptions to the grid — like the outages caused by Hurricane Helene and Milton — have put a spotlight on the urgency for manufacturers to get a handle on their power consumption. Unfortunately, when it comes to their power use, a lot of plastics processors are operating in the dark.

“We're noticing a lot of customers who don't know all these tips and tricks on the electrical side of things, paying a ton of money because they just don't quite know how they're being billed for the stuff,” said Ben Hartigan, marketing coordinator for the Absolute Group of Companies, which in North America sells Haitian IMMs as well as a line of robots.

According to Hartigan and representatives of other injection molding machine (IMM) makers, manufacturers can get help from their suppliers to spot opportunities for savings. OEMs also offer technology add-ons that can help IMM users curb their consumption.

While energy consumption rarely factors as a top consideration for plastics processors in the U.S., Hartigan warned against taking it for granted.

“In the summertime, that's when this becomes an issue, with everyone's AC units on ... we have a few [customers’] factories down South where they're told, ‘Hey, you can't run production for the next three days. Sorry,’ ” he said.

One way for processors to gain a bit more control over their energy is by analyzing when they use it the most. By staggering machine starts and leveling out power consumption, users can see big breaks on their bills, which are calculated based on peak usage periods.

“If you turn all your machines on all at once, we've seen customers hit like a 2,000 percent-over-usage thing, and then the utility company has no choice [but] to go, ‘We're going to bill you at this number,’ ” Hartigan explained.

To manage fluctuations in power needs, users of large-tonnage Absolute Group IMMs can turn off power to their machines’ clamp unit, while the heater bands — now available as standard — stay on the injection unit during mold changes. This strategy reduces the need to build up heat between molding processes, saving both time and energy.

Another strategy is to match clamping force to application. Rather than running at 100 percent of an IMM’s capabilities, a processor might be able to crank down the juice, saving money, as well as wear and tear on both the machine and tooling.

Too many users “beat on their machines for no reason,” Hartigan said.

“It's like driving your car, pedal to the metal, but you're going 25 miles an hour, but you're just accelerating super fast, for no reason,” he said.

Other OEMs have developed machinery technologies to optimize IMM energy consumption, regardless of how movements are actuated.

Nissei, for example, touts its IMMs’ dynamic braking and regenerative resistors “that will actually dump power back into the grid that could make them more energy-efficient,” said Joe Kendzulak, the executive technical adviser and GM of Nissei America.

The system, available for machines with clamping forces of at least 220 tons, also can return the energy back to the machine , instead of simply losing the energy as heat, he said.

Sodick goes even further. It's trying to cut out the need for a process that accounts for about one-third of all the energy that goes into the injection molding process: drying.

To reduce drying needs, IMM OEMs, including Sodick, can custom-design vents in their machines to allow volatiles, gases and moisture to dissipate from the injection molding process. Such vents are application-specific; however, machines with the vents also can perform other applications, with or without venting.

Often, though, the vents can become clogged — an issue that Sodick avoids with its special AI-Vent system that takes advantage of the latest artificial intelligence (AI) and vision technologies to optimize the process and automatically adjust the feeding pace and screw rotation.

Kohei Shinohara, senior VP for Sodick-Plustech, called it a “monitoring and thinking venting process. The goal is to reduce electric consumption by, in this case, [taking] out the material dryer from the molding process."

The system is especially effective because of the particulars of Sodick’s two-stage machines, which separate plasticizing and injection. While material in typical reciprocating-screw machines moves both back and forth with the screw, material in the two-stage machines doesn’t retract — making it easier for Sodick to pinpoint the optimal location for venting.

“That's the area, that's the position, that most gas [is] generated at the compression zone,” Shinohara said. “We can pin-spot the hole, and we can maximize the venting effect by that, so that makes our vented machine more effective than others.”

With AI-Vent, molders can process materials without using the time or energy required for drying — even when incorporating hygroscopic materials or batches made with recycled-content percentages of up to 50 percent. Drying demands about 36 percent of all the energy in injection molding, according to analysis by Sodick.

Like Sodick, many OEMs are investing in Industry 4.0 technologies to help their customers manage energy use.

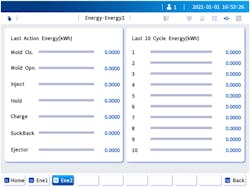

For example, the Absolute Group’s HT Energy, an energy-tracking module a standard feature on its IMMs, now is newly available as standard on its Generation 5-series IMMs.

Shibaura Machine has been touting a similar feature since NPE2024, when it rolled out its Sustain app.

The app offers a suite of features including real-time energy monitoring and predictive maintenance insights, enabling manufacturers to make data-driven decisions that drive continuous improvement and resource conservation. It can calculate the carbon footprint of each plastic part produced on Shibaura IMMs.

According to Hemantha Wansekera, CIO for the American division of the company, the app “empowers manufacturers to optimize energy usage, reduce waste and meet increasing demands for auditable carbon reporting.”

Having transparency into their energy consumption can save processors money — and maybe even prevent some headaches, according to IMM makers.

With energy-monitoring technologies, IMM users can better optimize their processes, said Peter Gardner, president of the U.S subsidiary of LS Mtron.

“Customers who are in the know and who are interested in doing so will play around with the process,” he said.

Contact:

Absolute Group of Companies, Parma, Ohio, 216-452-1000, www.absolutehaitian.com

LS Mtron, Duluth, Ga., 470-724-2263, www.lsmtron.com

Nissei America Inc., San Antonio, Texas, 714-693-3000, www.nisseiamerica.com

Shibaura, Elk Grove Village, Ill., 847-709-7000, https://shibaura-machine.com

Sodick Inc., Schaumburg, Ill., 847-310-9000, www.sodick.com